Let me start on a personal note. It took me less than a week to have +50 new LinkedIn connections and at least 10 meetings booked. All thanks to one little buzzword – PPA.

It seems like it’s what everybody wants to speak about in the (renewable) energy market. There seems to be a lot of power in the acronym PPA, which stands for Power Purchase Agreement.

As part of my little experiment, I even added the acronym to the headline in my LinkedIn profile. It worked!

What is PPA, and how can you limit some of its in-built risks?

Did you know that already back in 2017 Google achieved its 100% green electricity goal, sourcing all its energy (appr. 3GW) through a green corporate PPA?

Now, wouldn’t we all like to be like Google – securing electricity supply to our business and saving the planet at the same time?

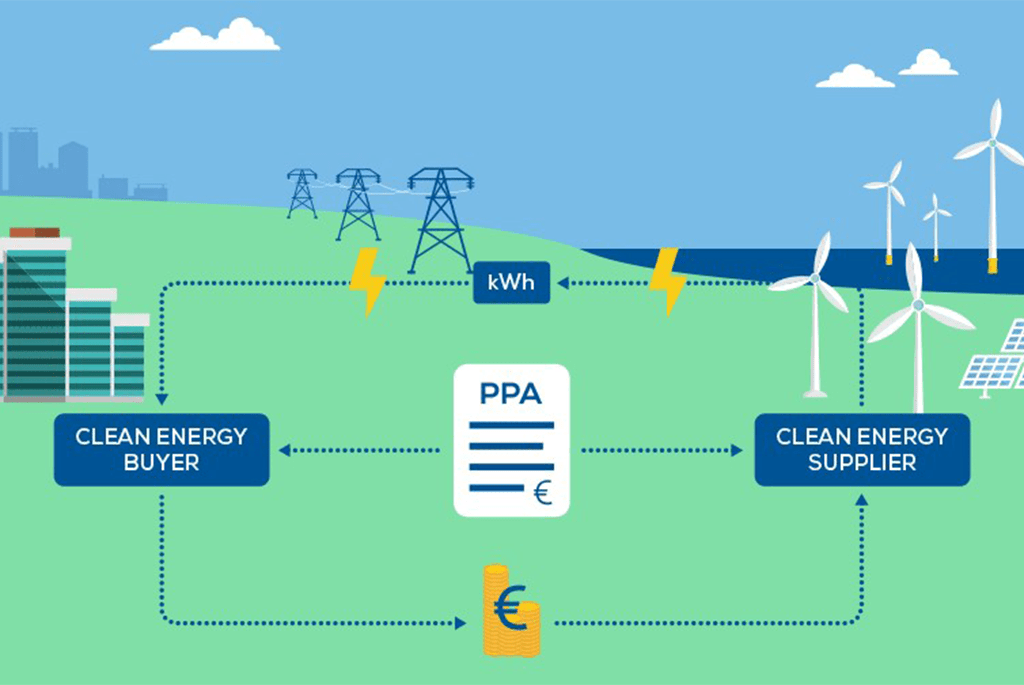

A (green/renewable) PPA is a very important agreement that regulates the sale and purchase of power between the renewable energy producer (clean energy producer) and the energy user (clean energy buyer). PPA is crucial to the bankability of the project. Basically, if you need funding for your wind or solar project – then you better have one in place.

So, yes! – renewable Power Purchase Agreements help deliver MORE renewable energy to the grid, hence saving thousands of tons of CO2. You and your company can make a difference and shape the renewable future by signing a PPA with a wind or solar energy generator.

Virtual, physical, corporate, sleeved, off-site, aggregated, long (e.g. 30 years) vs. shorter-term (e.g. 10 years), wind or PV park availability guarantee, curtailment, ‘buyers’ market’, subsidies ….

All of the above vocabulary is being used to further define the PPA type in question. Both from a legal perspective, as well as in terms of the physical conditions that the agreement will be based on.

PPA risks

It is not the goal of this article to discuss each term, but rather to emphasize, that they all have ONE thing in common – the RISK(s).

When drafting a PPA agreement, it is the responsibility of the energy generator to provide your business with as much financial certainty, during your PPA with them, as possible. We have tried to digest all the potential PPA risks into the following 3 questions:

- How will the market evolve over the time of my PPA agreement?

- How will the energy prices develop?

- What about the production/energy output?

– after all, we are dealing with entirely weather-dependent energy sources.

Now, we would highly recommend you discuss the market and energy prices (questions no. 1 and 2) with relevant experts.

What we’ve decided to focus on is what we are best at and what we’ve been helping the energy sector with for more than 10 years – is the DATA. Hang on for an answer to question no. 3 and learn how we can help you minimize the risks related to weather and hence to the expected production output of any given wind or solar park and portfolio.

The truth is that, at ConWX, we receive numerous requests on a weekly basis from energy companies, energy trading companies, and developers. They are eager to understand the impact a new wind or solar park will have on their existing portfolio.

- Will the new assets minimize or add to their current balancing risk?

- What influence will the new wind or solar park have on yearly production variability?

- Will it contribute to the diversification of the portfolio?

So, we’ve decided to make answers to these questions available online, as part of ConWX’s latest product development – the Portfolio Analyzer.

The Portfolio Analyzer

If you are dealing with multiple PPA analyses and a large variety of wind & solar parks and portfolios. Then ConWX Portfolio Analyzer may be the right solution for you.

You can easily simulate hourly productions for the last 20 year. Based on high-resolution weather hindcast data and empirical power curves for a wide selection of production units.

You can also download all the 20 years of power and weather data in hourly resolution – for the specific location and technical specifications of the park. You can then compare this data to the historical production data that you may have been provided with and hence calculate the MW/imbalance error – crucial in understanding your PPA risks.

Calculations can be carried out on individual assets, as well as on portfolios, and production is given as hourly and average load factors.

ConWX Portfolio Analyzer in brief

- The perfect tool to assess PPA risks

- Besides yearly production factors, you can also download 20 years of data in hourly resolution and do a projection for the future

- Since you really don’t know what will happen with the market and energy prices in 5 years – what you CAN minimize is the weather and hence production-related risk

Companies like Statkraft and Equinor have been happy users of ConWX Portfolio Analyzer.

If you’ve reached so far, reading this article, take a minute to watch this little appetizer video, we’ve made especially for you.

Now, if you only have a limited number of PPAs or other changes to your portfolio during the year, then our ad hoc park and portfolio analysis may be the solution you want to have a closer look at. What we do for energy and energy trading companies, but also PPA Platforms, like e.g. Pexapark, is a reanalysis or backtest, where we set up the new park(s) as if we were to make power forecasts for it.

Just like with ConWX Portfolio Analyzer, you are provided with a data series covering the realized production. This is where we use our historical forecast data. This analysis only gets better if you have historical production data that we can then use to fine-tune our models and choose the correct weights for your specific park, group of parks, or portfolio. Again, having historical production and our backtest makes it possible to calculate the MW error.

The information that we typically get from our customers, ahead of the backtest/reanalysis is plant location, capacity, hub height, etc. + historical observations.

RISKS are an inevitable part of the renewable PPA agreements – now and in the future. Equip yourself with tools that will help you minimize risks for you and your customers.